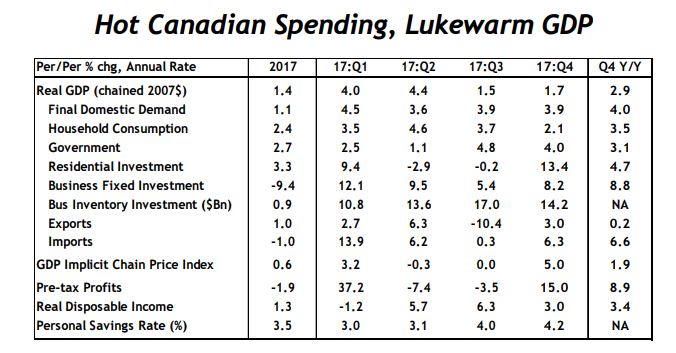

As expected, growth in the fourth quarter of last year paled in comparison to the robust performance of the first half. Statistics Canada revised up growth estimates for the first half of the year to 4.2%, from the initial estimate of 4%. Following economic expansion of a whopping 4.0% in Q1 and 4.4% in Q2, the second half slowed to a downward revised 1.5% in Q3 (posted initially at 1.7%) and 1.7% in Q4 (see table below, gratis CIBC Economics). Second half growth was about in line with the Bank of Canada’s assessment of long-run noninflationary potential growth. First-half growth was driven by robust consumer spending, particularly for durable goods, as well as strength in business investment. Residential construction was also a meaningful net contributor to expansion early last year.

The 2.9% expansion in the Canadian economy in 2017 was the fastest pace since 2011 following the tepid 1.4% growth pace of 2016. The unexpected strength allowed the federal government to post significantly smaller budget deficits for fiscal years 2017 and 2018 as announced in the October budgetary update. This week’s federal budget, however, showed that Ottawa chose to increase spending to offset these improvements, maintaining a double-digit deficit trajectory over the next five years. Rapid growth last year pushed the economy to full employment as labour markets improved dramatically. Now is not the time, therefore, for additional fiscal stimulus. Instead, it would have been more prudent to return the federal budget to a balanced position, particularly in light of potential risks to the economy in the future. As another round of NAFTA negotiations commence in Mexico city, we cannot help but be concerned about threats to Canada’s trade outlook.

Just yesterday, President Trump announced he intended to slap tariffs of 25% on steel imports and 10% on aluminium imports. Canada is the most significant supplier of foreign steel to the U.S. This announcement was roundly condemned by the international community. As always with Trump, details are uncertain, but according to Bloomberg News, the implications rippled through the seventh round of talks on the North American Free Trade Agreement in Mexico City.

Canada threatened to fire back if the U.S. makes good on this pledge, but held out hope that it could be exempt. The Canadian dollar is tied with the Mexican peso as the worst performing major currencies over the past month and is one of the worst performing over the past six months. The Canadian dollar was little changed after the GDP report.

London-based Rio Tinto, which ships more than 1.4 million metric tons of aluminium to the U.S. annually from Canada, said it would continue to lobby Washington for an exemption given the highly integrated Canada-U.S. market for autos and other manufactured goods.

“Aluminum from Canada has long been a reliable and secure input for U.S. manufacturers – including the defence sector,” Rio Tinto spokesman Matthew Klar said by email according to a report from Bloomberg News. “We will continue to engage with U.S. officials to underscore the benefits of the integrated North American aluminium supply chain, including the jobs it supports on each side of the border.” Also, shares of Canadian steel producer Stelco Holdings fell as much as 6.1%. The U.S. accounted for about 14% of Stelco’s sales in the last six months of 2017. Chief Executive Officer Alan Kestenbaum said on the company’s earnings call last week that he was hopeful Canada would be exempt from the tariffs.

Canadian Foreign Minister Chrystia Freeland fired back that, “it is entirely inappropriate to view any trade with Canada as a national security threat to the United States. Should restrictions be imposed on Canadian steel and aluminium products, Canada will take responsive measures to defend its trade interests and workers.”

Trump tweeted early this morning that, ‘trade wars are good and easy to win.’ There is not an economist in the world who agrees with this sentiment. What’s more, when U.S. prices for goods containing metals start to rise, inflation spikes and other countries start retaliating, President Trump will say “nobody knew that trade could be so complicated.” Hopefully, this is just more Trump nonsense, and cooler heads will prevail. But our government needs to have the ammo to cushion the economic effects of any such actions if NAFTA were to fall apart or Canadian businesses were hit with additional punitive tariffs. The Bank of Canada will indeed be very slow to raise rates in this environment, but fiscal stimulus should not be wasted on ineffective programs now when real stimulus might be needed as a counter-cyclical measure in the future.

The slowdown in the second half of last year was somewhat more than expected amid signs that indebted consumers have tamped down their spending sprees. Consumption growth in the fourth quarter was at its slowest pace since 2016. The deceleration in household spending was due in part to a higher savings rate, which increased to 4.2% in Q4, from 4.0% in Q3.

The underlying growth pace might be even slower than the fourth quarter figure suggests because of temporary strength in housing. Spending on residential structures surged to an annualized 13.4% in the final three months of last year, the most robust pace since 2012. The gain was led by unexpectedly strong new home construction, and the buyers rush to close home purchases before tighter mortgage qualification rules came into effect. We have already seen a marked slowdown in housing activity in the new year.

The jump in residential spending accounted for one percentage point of the 1.7% growth pace according to Statistics Canada. Residential investment had been a drag on growth in Q2 and Q3.

Exports recovered in Q4 after plunging in the third quarter, but it wasn’t enough to keep the trade sector from being a drag on growth as imports rose considerably. On a positive note, nonresidential business investment accelerated in Q4.