Patting himself on the back, the Finance Minister opened his speech by reminding us that “a little over two years ago…Canadians had the opportunity to stay the course. They could stick with a Government that favoured cuts and a set of failed policies that produced stubborn unemployment and the worst decade of economic growth since the depths of the Great Depression.” This, of course, was Stephen Harper’s Conservative Government. Never mind that the global financial crisis caused the recession, not the “failed policies” of the previous government. Throughout the budget documents, the message is that austerity was “needless” or “excessive.” Instead, Canadians chose, “a more confident and more ambitious approach…that gave Canadians the tools they needed to succeed. Starting with raising taxes on the wealthiest, so we could lower them for the middle class.”

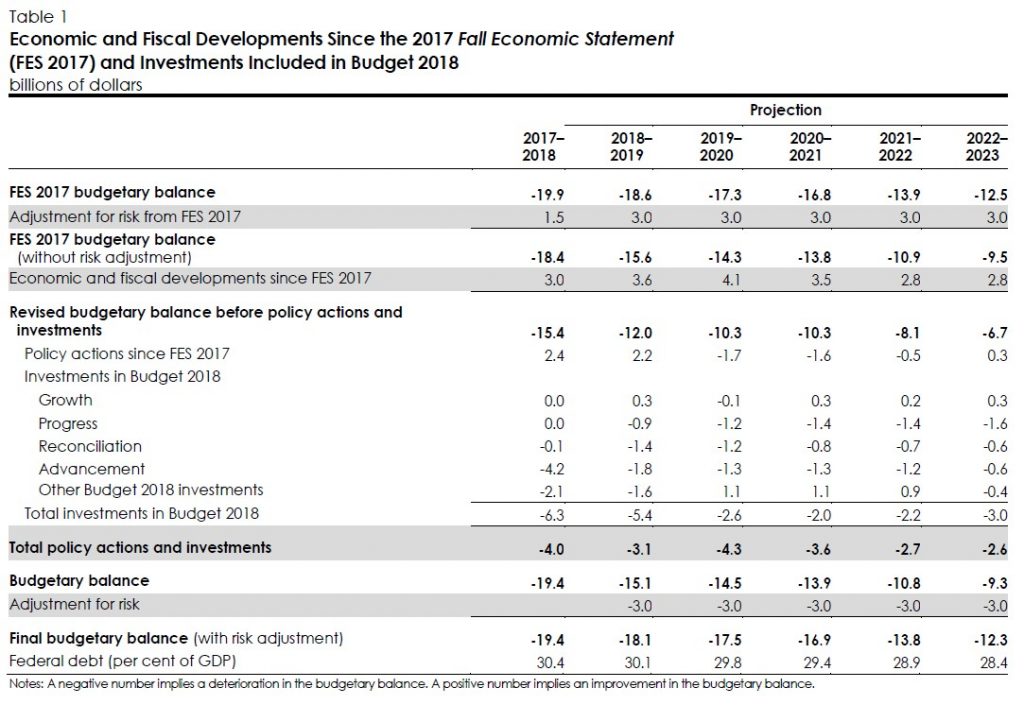

The Liberals have forgotten their promise to run deficits no larger than $10 billion and to balance the budget by 2019. Instead, they now see sound fiscal management as a declining debt-to-GDP ratio—never mind that double-digit deficits remain as far as the eye can see—to a stunning $12.3 billion deficit at the end of the forecast horizon in fiscal year (FY) 2022-23.

The deficit figures have indeed improved—down more than $2.0 billion in FYs 2017 and 2018–thanks to the stronger-than-expected economy and rapidly reduced unemployment last year. But, initiatives in today’s federal budget add $6.3 billion to the current year’s (ending March 31, 2018) budget deficit, $5.4 billion to next year’s federal red ink and an additional $2.0-to-$3.0 billion annually over the forecast horizon ending in FY 2022-23 (see Table below).

Fortunately, Canada has by far the lowest debt-to-GDP ratios in the G7, reflective of the austerity programs of the past, beginning in the mid-1990s and continuing until the financial crisis in 2008-09 when counter-cyclical global fiscal policy was essential to assure financial stability and rebounding economic activity by late-2009. While the U.S. and much of the rest of the developed world suffered the longest and deepest recession since the Great Depression, Canada’s was the shortest and mildest recession in the postwar period—contrary to the impression left by the Finance Minister in his opening remarks.

Thanks to this backdrop, the debt-to-GDP ratio in Canada will continue to decline despite continued fiscal stimulus. The ratio is forecast to gradually edge downward from 30.4% this year to 28.4% in 2022-23, assuming the economy continues to grow. Clearly, all bets are off if we hit a pothole, such as the end of NAFTA or a recurrence of plunging oil prices.

Budget 2018 proposes to:

• Put more money in the pockets of those who need it the most, by improving access to the Canada Child Benefit and introducing the Canada Workers Benefit, a stronger and more accessible benefit that will replace the Working Income Tax Benefit.

• Make significant progress towards equality of opportunity, by taking leadership to address the gender wage gap, supporting equal parenting, tackling gender-based violence and sexual harassment, and introducing a new entrepreneurship strategy for women.

• Support the next generation of researchers, by providing historic funding to increase opportunities for young researchers and provide them the equipment they need, while strengthening support for entrepreneurs to innovate, scale up and reach global markets.

• Advance reconciliation with Indigenous Peoples, by helping to close the gap between the quality of life of Indigenous and non-Indigenous people, providing greater support to keep First Nations children safe and supported within their communities, accelerating progress on clean drinking water, housing, and employment, and supporting recognition of rights and self determination.

• Protect the environment for future generations, by making historic investments to preserve our natural heritage, ensuring a price is put on carbon pollution across Canada, and extending support for clean energy projects.

• Uphold Canada’s shared values and support the health and wellness of Canadians, by partnering with provinces and territories to address the opioid crisis, taking action to advance national pharmacare, and bolstering support for Canada’s official languages.

This list summarizes 367 pages of more than 100 relatively small government initiatives impacting everything from Workers Benefits payments to low-income families, improving access to the Canada Child Benefit to supporting opportunities for women, pay equity for federal workers, strengthening trade, improving worker skills, and cracking down on tax evasion—all of this among the roughly 25 government actions described in Chapter 1 under the heading of Growth. The details of changes in the rules regarding the holding of passive investments inside private corporations as well as closing tax loopholes fall under this Growth rubric.

Chapter 2, called Progress, includes more than 35 initiatives under the headings of Investing in Canadian scientists and researchers, Stronger and more collaborative Federal science, and Innovation and Skills Plan—a more client-focussed Federal partner for business.

Chapter 3, Reconciliation, largely deals with Indigenous Peoples, including roughly 20 actions.

And finally, Chapter 4, called Advancement, covers the environment under Canada’s Natural Legacy, Canada and the World, Upholding Shared Values, and Security and Access to Justice. I lost count here at over 40 initiatives.

And, that’s not all! A bonus section called Equality, goes into detail regarding Canada’s commitment to gender budgeting, which includes $6.7 million over five years for “Statistics Canada to create a new Centre for Gender, Diversity and Inclusion Statistics, a Centre that will act as a Gender Budget Accounting data hub to support future, evidenced-based policy development and decision-making”.

I kid you not. At my rough count, I have been to 34 budget lock-ups, but I can’t remember ever seeing anything like this for sheer magnitude of the number of relatively tiny initiatives, nor can I ever remember leaving a lock-up with such a screaming headache.